The featured report from GMO’s Asset Allocation team examines how AI enthusiasm is distorting equity valuations and challenging disciplined investment frameworks.

-

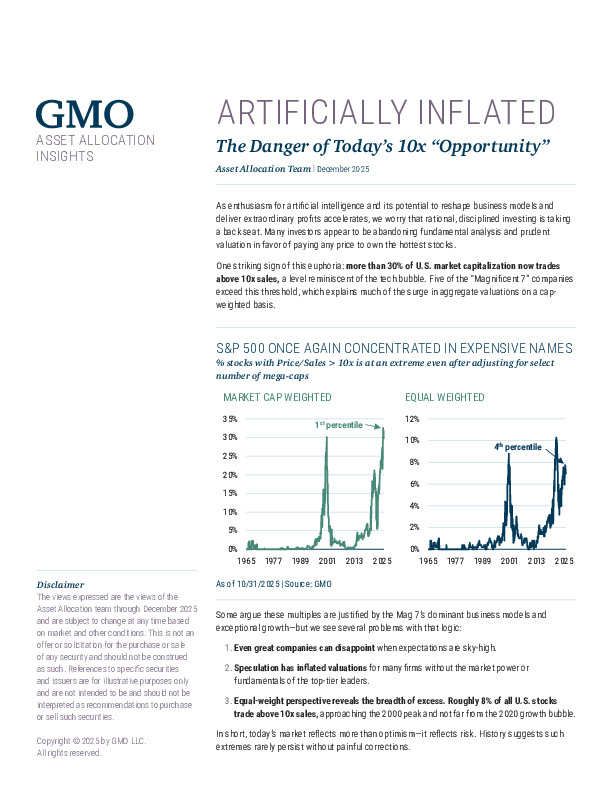

Over 30% of U.S. market capitalization now trades above 10× sales, a level historically associated with late-cycle excess and prior market bubbles.

-

Valuation pressure is not confined to a few mega-caps; equal-weighted data show a broad expansion of speculative pricing across the market.

-

High expectations leave little margin for error, raising the risk of sharp corrections even for high-quality companies.

How should investors recalibrate return assumptions when optimism, not fundamentals, is setting the price?

Om dit artikel te lezen heeft u een abonnement op Investment Officer nodig. Heeft u nog geen abonnement, klik op "Abonneren" voor de verschillende abonnementsregelingen.