Drawing on Van Lanschot Kempen’s latest analysis, the report outlines why a deeply out-of-favour segment may be nearing a turn.

-

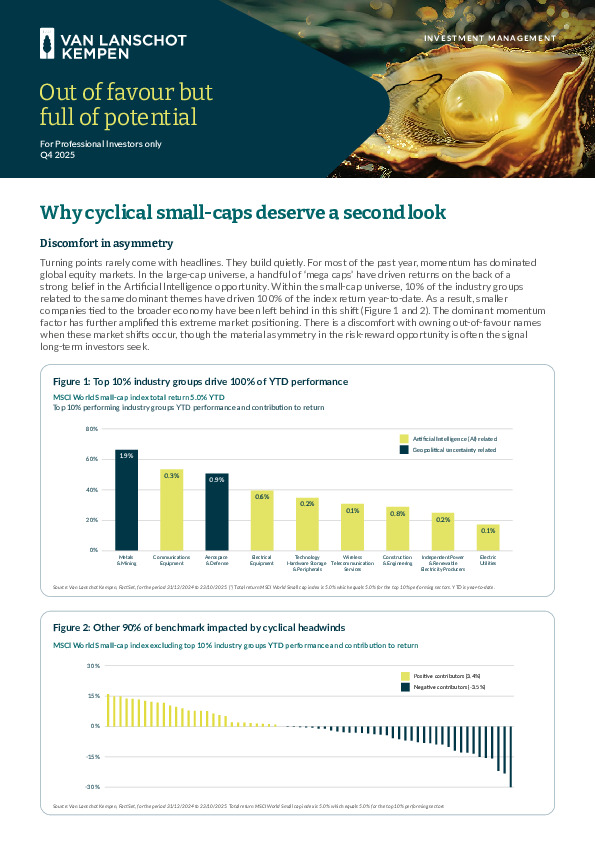

Prolonged industrial, consumer and manufacturing downcycles have weighed on small caps, yet easing-rate expectations historically mark the early stages of their outperformance.

-

Europe’s fiscal push—particularly Germany’s sizeable infrastructure and defence stimulus—could reignite demand and amplify operating leverage across smaller firms.

-

Valuations sit well below long-term averages, creating a favourable asymmetry in risk-reward should economic conditions stabilise.

If you’re assessing where cyclical exposure may begin to pay off again, the full report provides the detailed signals behind this potential shift.

Om dit artikel te lezen heeft u een abonnement op Investment Officer nodig. Heeft u nog geen abonnement, klik op "Abonneren" voor de verschillende abonnementsregelingen.