By Alexandra Christiansen , Portfolio Manager of Nordea’s Global Climate Transition Engagement Strategy

As we enter the next phase of global decarbonisation, institutional investors are rethinking their strategies. Instead of avoiding high-emitting sectors like cement, steel, utilities, and waste management, many are now investing in their transformation—advancing climate goals while capturing long-term value.

These sectors are major contributors to global emissions but remain essential to modern economies. Divesting from them may seem like a straightforward approach to portfolio decarbonisation, but this is not reflective of economic reality and risks sidelining the progress needed to reduce emissions in the real economy. Increasingly, investors are taking a different approach: backing “improvers”—companies with credible plans and capacity to deliver value-creative decarbonisation.

This strategy is already delivering results. For example, the Nordea’s Global Climate Transition Engagement Strategy, which targets improvers, last year achieved real economy emissions savings of 24 tonnes of CO2 per million euros invested—over 12 times the reduction rate of the MSCI ACWI Index1, and during the past 3 years has achieved a 16% reduction in carbon intensity, significantly outpacing the MSCI ACWI’s modest 1.6% decrease during the same period2. Moreover, attractive investment returns were not compromised to achieve this result.

Why invest in high-emitting sectors?

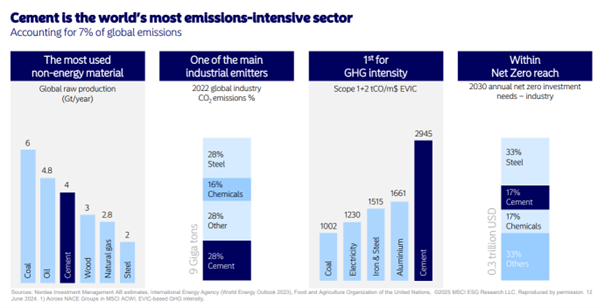

Heavy industry and utilities are among the largest contributors to global emissions. Cement alone is responsible for approximately 7% of global CO2 emissions.3 Steel, which is essential for everything from infrastructure to renewable energy, is another high-emitting sector. Utilities, meanwhile, play a key role in accelerating the energy transition by replacing fossil fuel generation with renewable energy and modernizing power grids.

Divesting from these sectors would remove the opportunity to influence transition strategies and forego attractive investment returns from value-creative decarbonisation pathways. Instead, active ownership allows investors to engage with companies at a time when policy and market dynamics are creating new incentives for decarbonization. For instance, the vast majority of cement emissions come from clinker production, with over half stemming from chemical processes that energy substitution alone can’t address—highlighting the need for systemic change.4 We believe we have an edge in understanding the technological, policy and consumer behaviour shifts in this industry better than the wider market, and can take advantage of this to generate alpha and partake in meaningful decarbonisation delta.

Decarbonization can enhance valuation

A company’s approach to decarbonization can significantly affect its valuation. Our valuation work underlines significant value destruction to businesses in industries like cement if no action is taken to avoid increasing carbon costs, but shows meaningful upside to future cash flows with credible decarbonisation strategies. The waste management sector is another example of where investing in landfill-to-renewable gas projects will reduce emissions and generate additional upside to earnings. US utilities are also transitioning from fossil fuels to renewables, supporting long-term earnings growth.5

Active ownership can drive real impact

Engagement-based strategies are beginning to deliver measurable impact, measured in terms of both real economy emissions reductions and alpha generation as the market rewards these credible decarbonisation pathways. Avoiding high-emitting sectors is no longer seen as a viable long-term strategy. Instead, we see investors taking a more thoughtful, long-term approach, recognising that integrating sustainability is about positioning for durable growth and stronger competitive positions. What we are seeing is a maturing of the conversation. Clients are moving beyond screens and exclusions, and increasingly seeking real-world impact.

1 Nordea Asset Management: Carbon footprint (tCO2e/mEUR invested) data as of 30/12/2024

2 The performance represented is historical; past performance is not a reliable indicator of future results and investors may not recover the full amount invested. The value of your investment can go up and down, and you could lose some of all of your invested money.

3 Nordea Investment Management AB estimates, International Energy Agency (World Energy Outlook 2023), Food and Agriculture Organization of the United Nations, ©2025 MSCI ESG Research LLC. Reproduced by permission. 12

June 2024. 1) Across NACE Groups in MSCI ACWI. EVIC-based GHG intensity.

4 Global Cement and Concrete Association (2050 Cement and Concrete Industry Roadmap for Net Zero Concrete), Mission Possible Partnership (Concrete and Cement Transition Strategy 2023).

5 Nordea Investment Management AB. Reference to companies or other investments mentioned should not be construed as a recommendation to the investor to buy or sell the same but is included for the purpose of illustration.

Nordea Asset Management is the functional name of the asset management business conducted by the legal entities Nordea Investment Funds S.A., Nordea Investment Management AB and Nordea Funds Ltd and their branches and subsidiaries. This material is intended to provide the reader with information on Nordea Asset Management specific capabilities, general market activity or industry trends and is not intended to be relied upon as a forecast or research. This material, or any views or opinions expressed herein, does not amount to an investment advice nor does it constitute a recommendation to buy, sell or invest in any financial product, investment structure or instrument, to enter into or unwind any transaction or to participate in any particular trading strategy. Unless otherwise stated, all views expressed are those Nordea Asset Management. Views and opinions reflect the current economic market conditions, and are subject to change. Any investment decision should be based on the Offering Memorandum or any similar contractual arrangement. All investments involve risks; losses may be made. While the information herein is considered to be correct, no representation or warranty can be given on the ultimate accuracy or completeness of such information. Prospective investors or counterparties should discuss with their professional tax, legal, accounting and other adviser(s) with regards to the potential effect of any investment that they may enter into, including the possible risks and benefits of such investment, and independently evaluate the tax implications, suitability and appropriateness of such potential investments. Published by the relevant Nordea Asset Management entity. Nordea Investment Management AB and Nordea Investment Funds S.A. are licensed and supervised by the Financial Supervisory Authority in Sweden and Luxembourg respectively. Nordea Funds Ltd is a management company incorporated in Finland and supervised by the Finnish Financial Supervisory Authority. This material may not be reproduced or circulated without prior permission. © Nordea Asset Management. In the United Kingdom: Published by Nordea Asset Management UK Limited, a private limited company incorporated in England and Wales with registered number 11297178; which is authorised and regulated by the Financial Conduct Authority. Registered office at 5 Aldermanbury Square, London, United Kingdom, EC2V 7AZ. In Switzerland: Published by Nordea Asset Management Schweiz GmbH, which is registered under the number CHE-218.498.072 and authorised in Switzerland by FINMA. In Singapore: For institutional investors only. Published by Nordea Asset Management Singapore, which is regulated by the Monetary Authority of Singapore (company registration number: 202219416W). The address of Nordea Asset Management Singapore is 138 Market Street, #05-01 CapitaGreen, Singapore 048946.