As income drives fixed income outcomes and credit dispersion rises, BBB CLOs warrant closer attention. Portfolio manager Denis Struc and EMEA Client Portfolio Manager Lead Kareena Moledina explore how BBB CLOs combine yield, resilience and diversification across market cycles.

A compelling yield and diversification opportunity in BBB CLOs

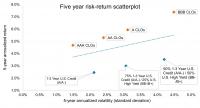

Income is set to be a primary driver of fixed income returns as credit spreads across traditional corporate markets sit at or near historical tights. In such an environment, we are reminded that the starting yield of an investment is the best indicator of future returns.

As part of the investment‑grade universe, BBB‑rated CLOs offer high‑yield‑comparable income through a higher‑quality structure, with additional diversification benefits from floating‑rate coupons. This combination enables investors to pursue income and diversification while mitigating interest rate risk and avoiding the single name vulnerabilities embedded in lower quality corporate credit.