Main Points:

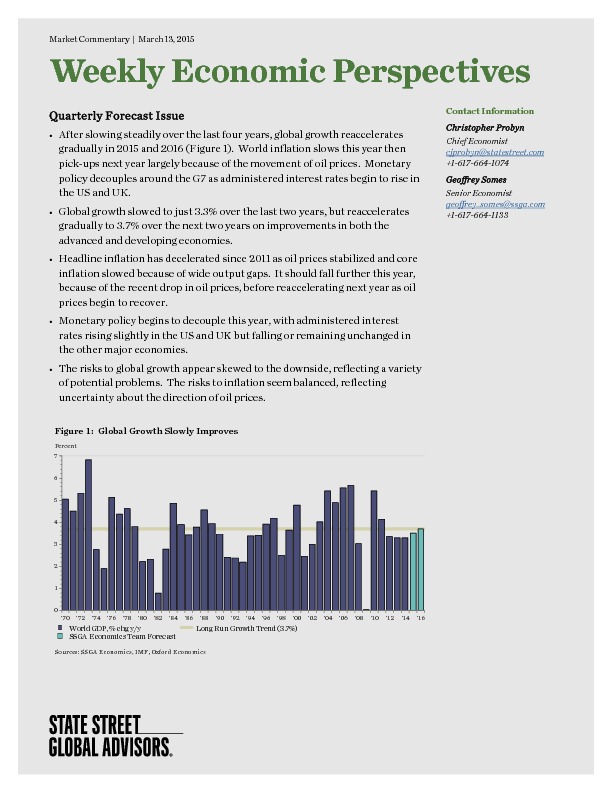

- Global growth slowed progressively over the last four years, with both the advanced and developing economies losing momentum.

- The risks to global growth still appear skewed to the downside, but less so than before. The largest downside risk reflects geopolitical uncertainties.

- From mid-2011 to mid-2014, oil prices trended erratically sideways leaving core (excluding food and energy) prices to drive headline inflation steadily lower because of large output gaps. Since June 30, however, oil prices have fallen around 50% consigning them the dominant role in the evolution of inflation over the near term.

- Because of the extent and timing of the oil price decline, inflation should decelerate quite sharply this year. Indeed, global inflation slows four ticks to 3.3% on 1.0 percentage point deceleration in the advanced economies to just 0.4%.

- Monetary policy finally begins to decouple around the G7 this year , with two central banks raising interest rates, and the rest at least holding the line, if not actually increasing the degree of monetary accommodative through additional asset purchases.