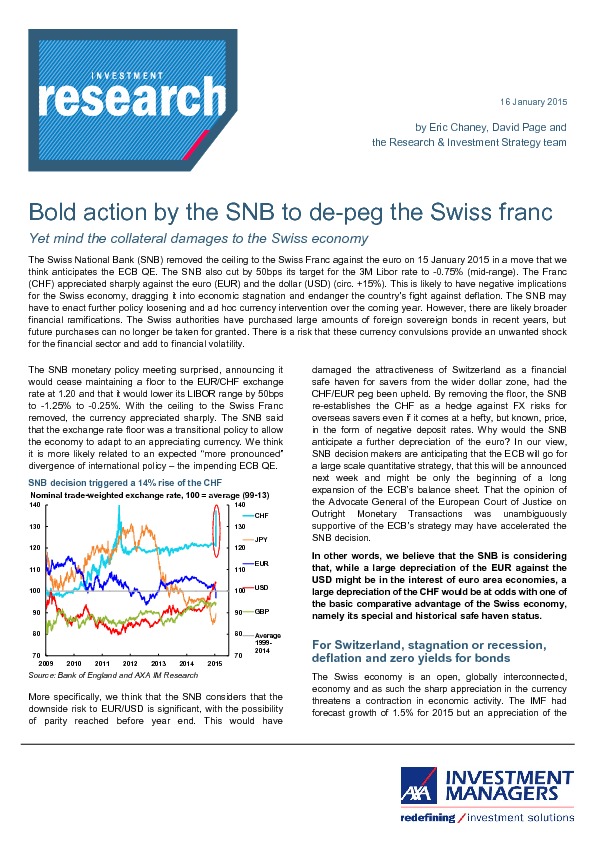

The Swiss National Bank (SNB) removed the ceiling to the Swiss Franc against the euro on 15 January 2015 in a move that we think anticipates the ECB QE. The SNB also cut by 50bps its target for the 3M Libor rate to -0.75% (mid-range). The Franc (CHF) appreciated sharply against the euro (EUR) and the dollar (USD) (circ. +15%). This is likely to have negative implications for the Swiss economy, dragging it into economic stagnation and endanger the country’s fight against deflation. The SNB may have to enact further policy loosening and ad hoc currency intervention over the coming year. However, there are likely broader financial ramifications. The Swiss authorities have purchased large amounts of foreign sovereign bonds in recent years, but future purchases can no longer be taken for granted. There is a risk that these currency convulsions provide an unwanted shock for the financial sector and add to financial volatility.