This weekly note examines how rising bond yields and concentrated equity drivers are exposing the limits of traditional portfolio construction.

-

A global bond selloff has weakened the defensive role of long-dated Treasuries, underscoring why classic equity–bond diversification offers less ballast than in past cycles.

-

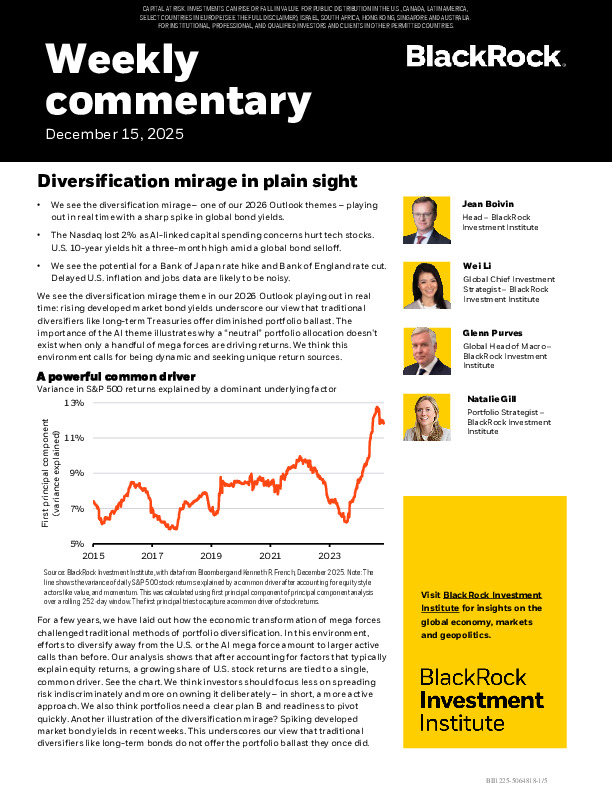

Equity returns are increasingly driven by a single dominant force, with AI-linked dynamics accounting for a growing share of U.S. market performance.

-

The environment favors active positioning, alternative return sources and clear contingency planning as neutral allocations become harder to define.

For a deeper look at how mega forces are reshaping risk management and asset allocation, the full commentary lays out the case in detail.