Nuveen's in-depth analysis clarifies how duration provides a more accurate measure of bond volatility than maturity alone, offering valuable insights for fixed income investors navigating rate-sensitive markets.

-

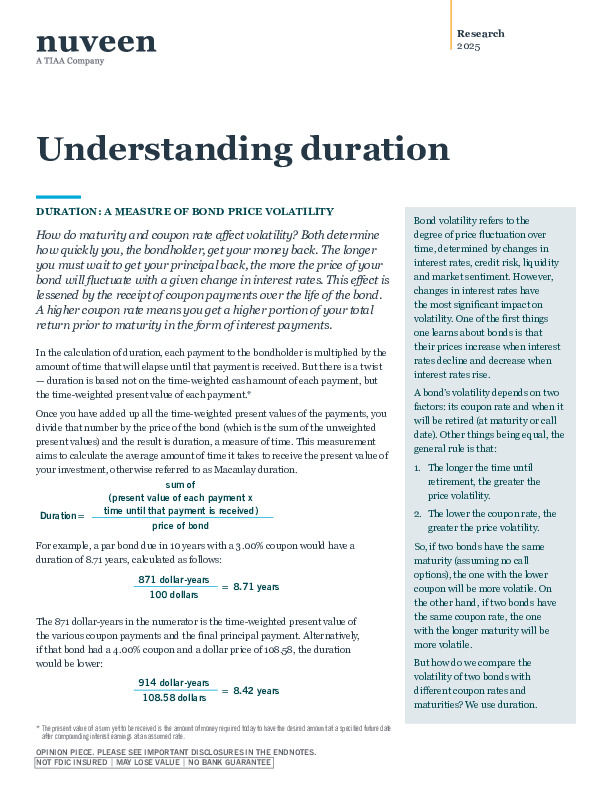

Key volatility driver: Duration captures how a bond’s price responds to rate changes—longer durations mean greater sensitivity.

-

Strategic relevance: Modified and option-adjusted duration help assess pricing scenarios, especially with callable or premium bonds.

-

Portfolio application: Duration targeting allows managers to fine-tune risk exposure while balancing income, price stability, and return potential.

For a deeper understanding of how to apply duration analysis in today’s bond market, consider how these concepts integrate with your current strategy.