Key points

- The RMB FX market has enjoyed a period of stability, following the turmoil early in the year. Capital outflows have eased, depreciation expectations have dissipated, and the stock of FX reserves has increased slightly, partly due to valuation effect.

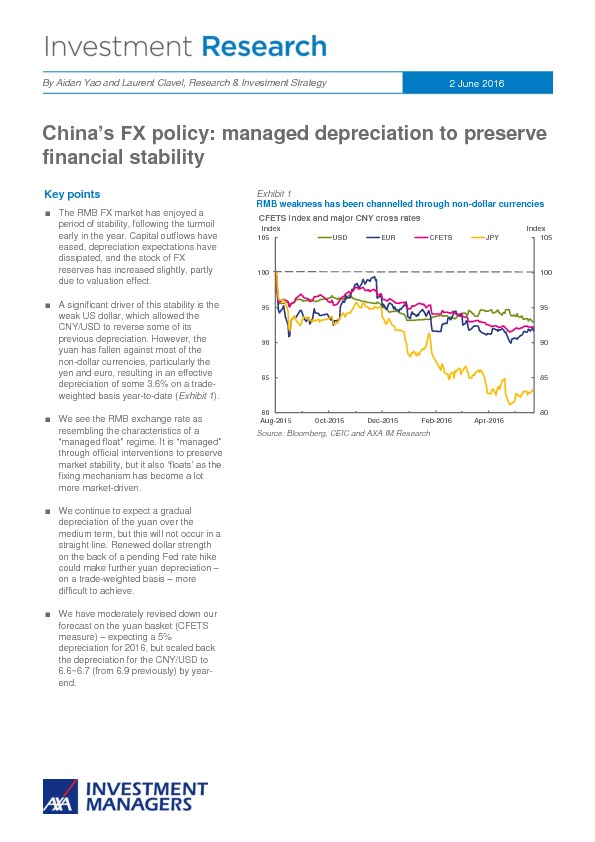

- A significant driver of this stability is the weak US dollar, which allowed the CNY/USD to reverse some of its previous depreciation. However, the yuan has fallen against most of the non-dollar currencies, particularly the yen and euro, resulting in an effective depreciation of some 3.6% on a trade- weighted basis year-to-date (Exhibit 1).

- We see the RMB exchange rate as resembling the characteristics of a “managed float” regime. It is “managed” through official interventions to preserve market stability, but it also ‘floats’ as the fixing mechanism has become a lot more market-driven.

- We continue to expect a gradual depreciation of the yuan over the medium term, but this will not occur in a straight line. Renewed dollar strength on the back of a pending Fed rate hike could make further yuan depreciation – on a trade-weighted basis – more difficult to achieve.

- We have moderately revised down our forecast on the yuan basket (CFETS measure) – expecting a 5% depreciation for 2016, but scaled back the depreciation for the CNY/USD to 6.6~6.7 (from 6.9 previously) by year- end.