China's Mortgage 'Boycott'

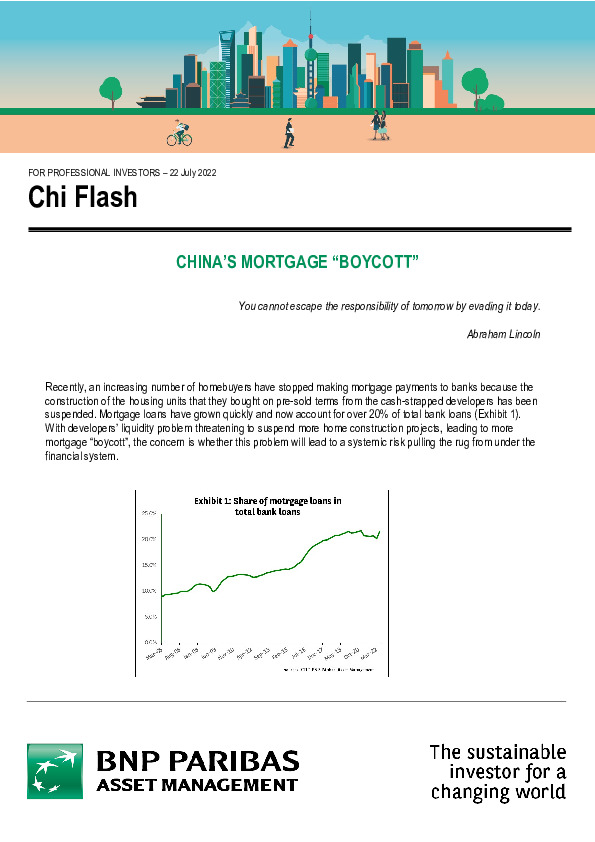

Recently, an increasing number of homebuyers have stopped making mortgage payments to banks because the construction of the housing units that they bought on pre-sold terms from the cash-strapped developers has been suspended. Mortgage loans have grown quickly and now account for over 20% of total bank loans (Exhibit 1). With developers’ liquidity problem threatening to suspend more home construction projects, leading to more mortgage “boycott”, the concern is whether this problem will lead to a systemic risk pulling the rug from under the financial system.

Enregistrez-vous ou connectez-vous pour lire la suite. Investment Officer est une plateforme journalistique indépendante à destination des professionnels de l’industrie belge des investissements.

L’abonnement est GRATUIT pour les professionnels actifs au sein de banques et gestionnaires d’actifs indépendants.