China's Mortgage 'Boycott'

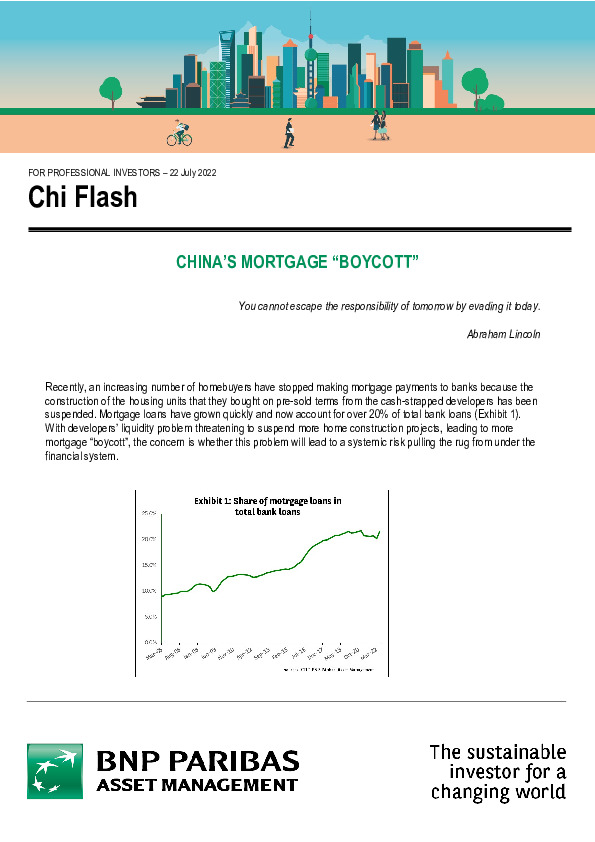

Recently, an increasing number of homebuyers have stopped making mortgage payments to banks because the construction of the housing units that they bought on pre-sold terms from the cash-strapped developers has been suspended. Mortgage loans have grown quickly and now account for over 20% of total bank loans (Exhibit 1). With developers’ liquidity problem threatening to suspend more home construction projects, leading to more mortgage “boycott”, the concern is whether this problem will lead to a systemic risk pulling the rug from under the financial system.

Registreer of log in om verder te lezen. Investment Officer is een onafhankelijk journalistiek platform voor professionals werkzaam in de Belgische beleggingsindustrie.

Een abonnement is GRATIS voor professionals die werkzaam zijn bij banken en onafhankelijke vermogensbeheerders.