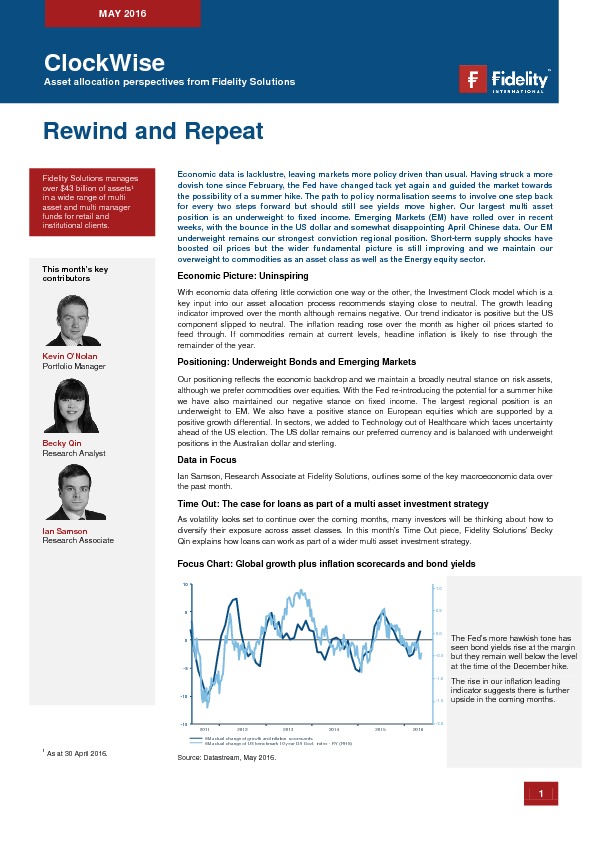

Economic data is lacklustre, leaving markets more policy driven than usual. Having struck a more dovish tone since February, the Fed have changed tack yet again and guided the market towards the possibility of a summer hike. The path to policy normalisation seems to involve one step back for every two steps forward but should still see yields move higher. Our largest multi asset position is an underweight to fixed income. Emerging Markets (EM) have rolled over in recent weeks, with the bounce in the US dollar and somewhat disappointing April Chinese data. Our EM underweight remains our strongest conviction regional position. Short-term supply shocks have boosted oil prices but the wider fundamental picture is still improving and we maintain our overweight to commodities as an asset class as well as the Energy equity sector.