Vincent Vinatier, Portfolio Manager

What long-term trend are we observing?

The payments sector has experienced a significant amount of consolidation in recent years, with pure payment firms such as WorldPay and Visa establishing themselves as larger players in the industry through mergers and acquisitions (M&A).

In 2018, total investments through private equity, venture capital and M&As rose considerably, largely driven by deals in the payments sector. In Europe, H1 2018 saw a notable transactions by US credit card processing firm Vantiv’s $10.4 billion merger with UK-based WorldPay1, which was finalised in January 2018.2 PayPal completed its $2.2 billion acquisition of Swedish digital payments firm iZettle in September 20183, while 2019 has so far seen the merger between Nets and Concardis4 for a reported $6 billion.5

Meanwhile, the announcement of three mega-deals in 2019 is anticipated to catapult aggregate fintech deals in the US to new heights. The US payments deal bonanza in 2019 was kick-started by fintech provider Fiserv, which agreed to acquire payment processor First Data for $22 billion in January.6 In March, Fidelity National Information Services agreed to buy WorldPay for $35 billion, marking the biggest payments deal to date.7 The third mega-merger came from Global Payments, whose deal with Total System Services in May has been valued at $21.5 billion.8

What does this mean for investors?

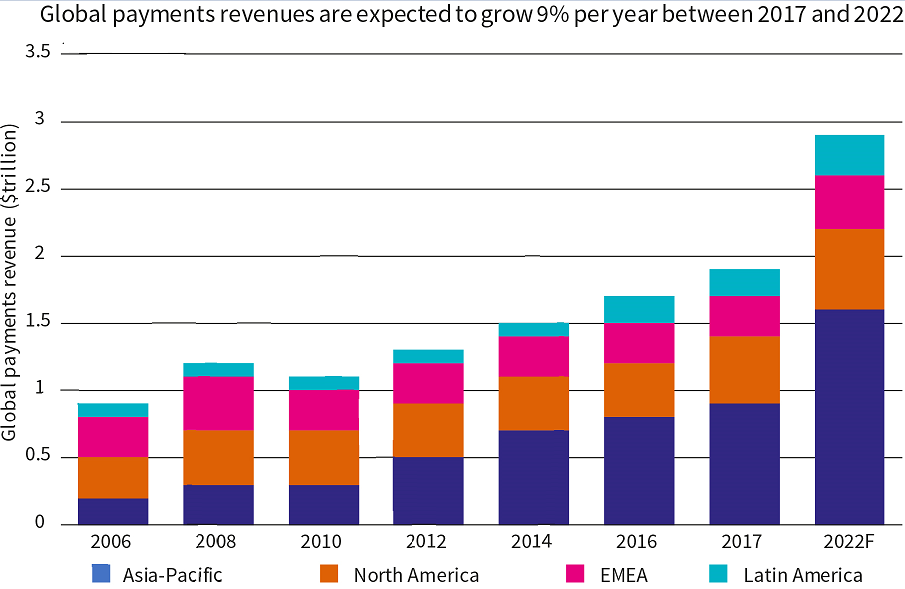

The global payments industry is set to reach $3 trillion in revenue by 2023 as a result of rapid consolidation9, as more firms look to increasingly invest in technology in order to keep pace with the transition towards digitalisation.

Source: Global payments 2018: A dynamic industry continues to break ground, McKinsey & Company, October 2018

This figure is expected to accelerate, driven largely by ongoing market innovation to support key trends around e-commerce growth and increasing omni-channel and cross-border activity. The shift away from cash is likely to serve as the biggest driver of the global electronification of payments: in the UK, contactless transactions rose by almost a third in 2018 to £69 billion.10 Within Asia, the share of digital payments in China rose from 4% in 2012 to 34% in 201711, illustrating the huge potential for market penetration. Despite its preference for cash, Japan has seen a high adoption for prepaid card solutions like SUICA.

Private equity houses and pure play payments firms have led M&A activity in the payments sector. Examples include Advent International and Bain Company, with both participating in the Nets/Concardis merger12, and Nordic Capital, which acquired Swedish online banking payments provider Trustly.13 Payments firms look to sustain their upward growth trajectory by increasing the volume of transactions through cross-border coverage and, in time, lowering the overall cost of maintaining their platforms, to become complete service providers.

The US has seen increased interest in business-to-business deals, including Mastercard’s acquisition of Transfast14 and JPMorgan’s acquisition of medical payments tech firm InstaMed.15 Meanwhile, Latin America is home to a new fintech unicorn, Prisma Medios de Pago, which achieved its status following the buyout of a 51% stake in the firm by Advent International.16 Moreover, in October 2018, Visa invested in Brazil-based Conductor to develop solutions for tokenising payments through mobile wallets.17

Outlook

The rapid rise in contactless adoption worldwide has taken the payments services sector to new heights, complementing a range of industries from retail to insurance. The shifting digital landscape has meant that it is necessary that such companies continue to substantially invest in technology in order to remain relevant and retain their market share. Mega-deals are starting to put some banks under pressure, with strategic moves such as distribution partnerships needed for them to reach their target markets.

We expect a sustained level of payments consolidation, which will undoubtedly see a divergence between the winners and losers in catering to consumers in today’s digital age. The three mega-deals in the US illustrate the fast pace of digital disruption and further strengthen the industry’s value proposition.

Not for Retail distribution: This document is intended exclusively for Professional, Institutional, Qualified or Wholesale Clients / Investors only, as defined by applicable local laws and regulation. Circulation must be restricted accordingly.This document is for informational purposes only and does not constitute investment research or financial analysis relating to transactions in financial instruments as per MIF Directive (2014/65/EU), nor does it constitute on the part of AXA Investment Managers or its affiliated companies an offer to buy or sell any investments, products or services, and should not be considered as solicitation or investment, legal or tax advice, a recommendation for an investment strategy or a personalized recommendation to buy or sell securities.Due to its simplification, this document is partial and opinions, estimates and forecasts herein are subjective and subject to change without notice. There is no guarantee forecasts made will come to pass. Data, figures, declarations, analysis, predictions and other information in this document is provided based on our state of knowledge at the time of creation of this document. Whilst every care is taken, no representation or warranty (including liability towards third parties), express or implied, is made as to the accuracy, reliability or completeness of the information contained herein. Reliance upon information in this material is at the sole discretion of the recipient. This material does not contain sufficient information to support an investment decision.Issued in the UK by AXA Investment Managers UK Limited, which is authorised and regulated by the Financial Conduct Authority in the UK. Registered in England and Wales No: 01431068. Registered Office: 7 Newgate Street, London EC1A 7NX.In other jurisdictions, this document is issued by AXA Investment Managers SA’s affiliates in those countries. |