After a turbulent start to the year, Robeco’s February Market Monitor assesses how portfolios are being recalibrated amid policy noise, commodity swings, and resilient fundamentals.

-

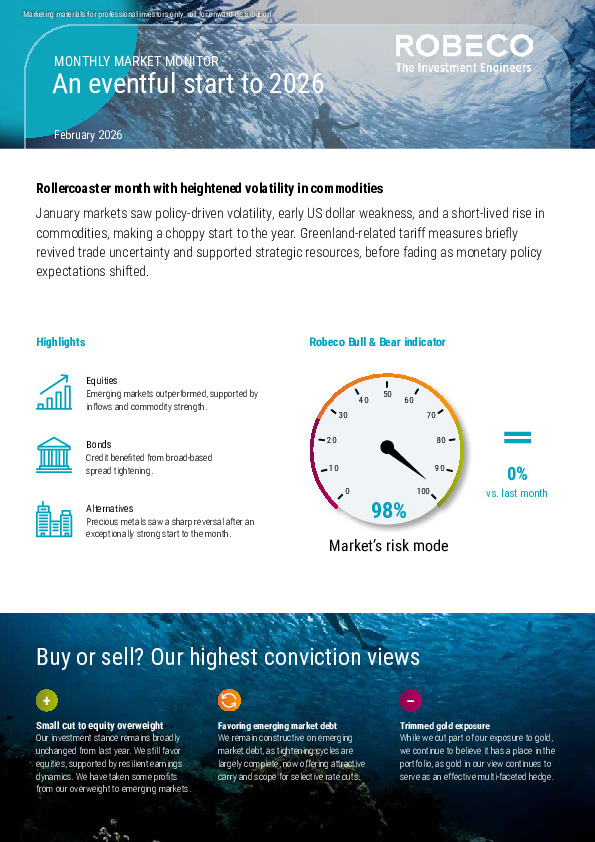

Equities remain favoured on earnings strength, though exposure is trimmed at the margin, with profits taken in emerging market equities after a strong run.

-

Emerging market debt stands out as a high-conviction allocation, supported by attractive carry and the completion of most tightening cycles.

-

Gold exposure is reduced but retained as a strategic hedge, with its role increasingly shaped by real rates, central bank credibility, and diversification needs.

How should investors balance conviction with caution as 2026 unfolds? The full monitor explores positioning choices across assets in detail.