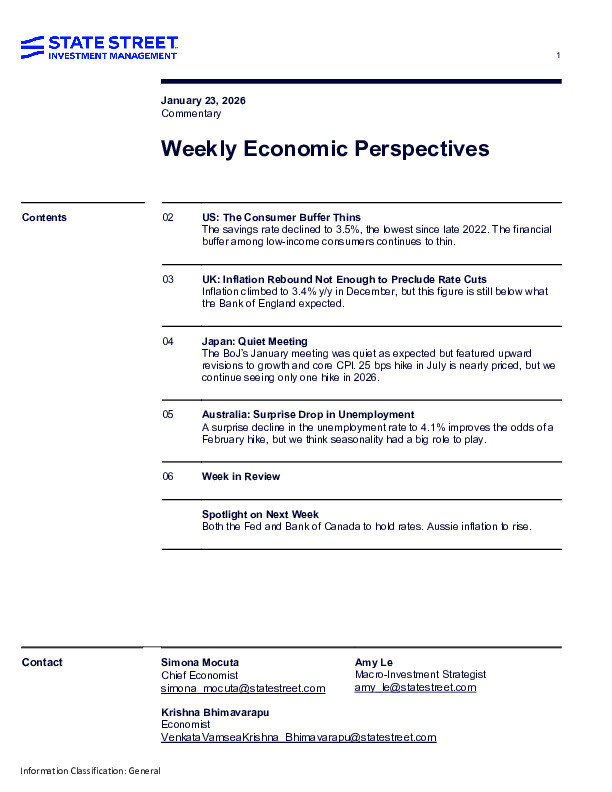

State Street Investment Management’s Weekly Economic Perspectives (Simona Mocuta, Amy Le and Krishna Bhimavarapu) highlights where macro risks are shifting as 2026 begins.

-

The US personal saving rate fell to 3.5% (three-year low), signalling reduced resilience for lower-income consumers as job growth slows.

-

UK inflation rose to 3.4% y/y, but remains below Bank of England expectations, keeping March and June rate cuts in play.

-

Japan’s data improved (manufacturing PMI 51.5), yet inflation eased to 2.1%, supporting a “one hike in 2026” base case.

Explore the full commentary for the cross-country dashboard and next-week catalysts shaping rates and risk assets.

Pour lire cet article, vous avez besoin d'un abonnement à Investment Officer. Si vous n'avez pas encore d'abonnement, cliquez sur 'Abonner' pour connaître les différentes formules d'abonnement.