The October 2025 CIO View – Portfolio Perspectives from DWS outlines a measured tilt back toward risk, supported by improving macro signals and strong liquidity conditions.

-

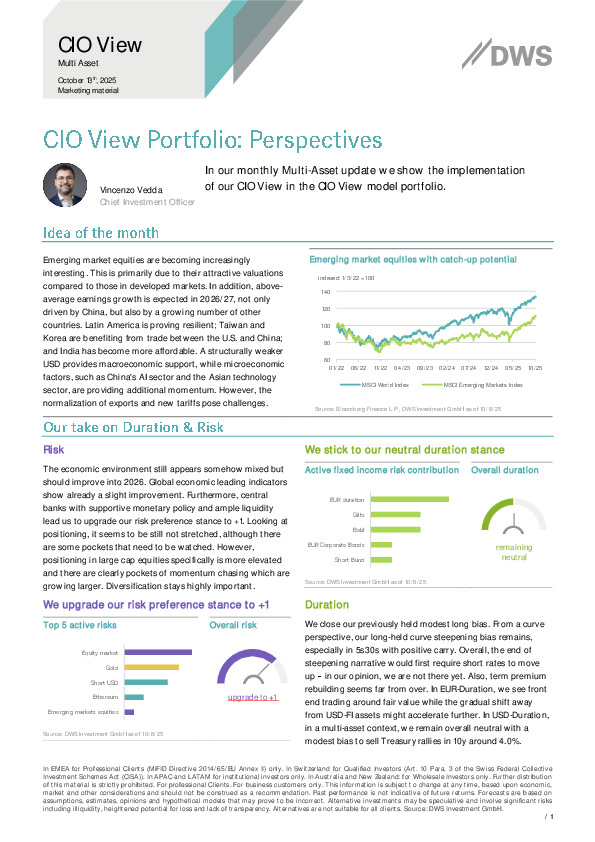

Emerging market equities are upgraded to +1, driven by attractive valuations, improving earnings momentum, and USD weakness; Asia benefits from AI-linked tech demand while Latin America remains resilient.

-

Overall risk stance moves to +1, supported by easier central bank policy and stabilizing global indicators, though DWS warns of crowded positioning in large caps and stresses diversification.

-

Neutral duration retained with a bias toward curve steepening, while EUR investment-grade credit stays favored over U.S. IG; currency positioning remains long EUR and JPY versus USD.

How can portfolios lean into EM growth without overexposure to late-cycle volatility? See the full positioning details in the report.