This commentary highlights tactical views across equities and fixed income following the Fed’s renewed easing.

-

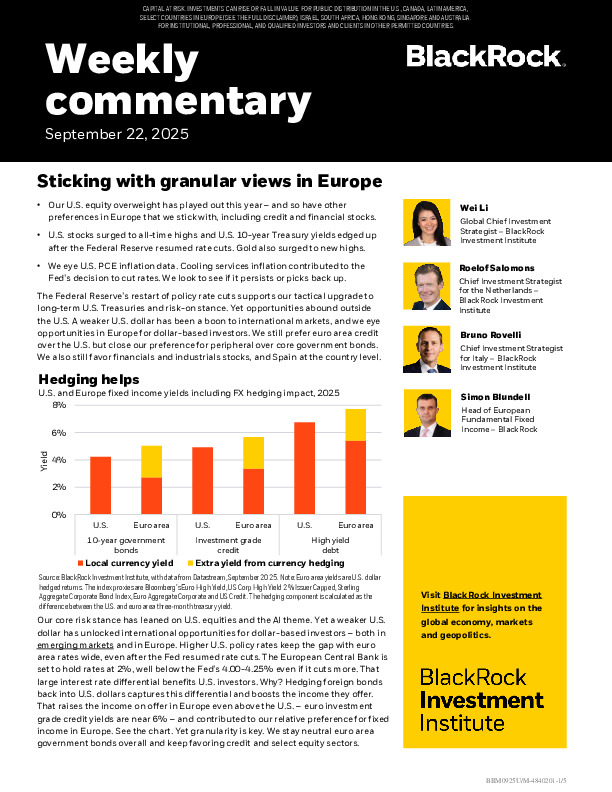

Europe Credit Edge: Euro area investment grade credit yields near 6% (USD-hedged) now outcompete U.S. credit, reinforcing a preference for corporate over sovereign exposure.

-

Equity Granularity: Select European sectors—financials, industrials, and utilities—continue to show relative strength; Spain remains favored for growth and EM linkages.

-

Global Positioning: U.S. equities remain overweight on AI-driven earnings; Japan stands out strategically on reforms and inflation dynamics.

How should investors balance U.S. resilience with Europe’s yield and sector opportunities? Explore the full report for actionable insights.

Pour lire cet article, vous avez besoin d'un abonnement à Investment Officer. Si vous n'avez pas encore d'abonnement, cliquez sur 'Abonner' pour connaître les différentes formules d'abonnement.