This weekly commentary by the BlackRock Investment Institute analyzes the resurgence of U.S. tariff and tax policies and their implications for markets.

-

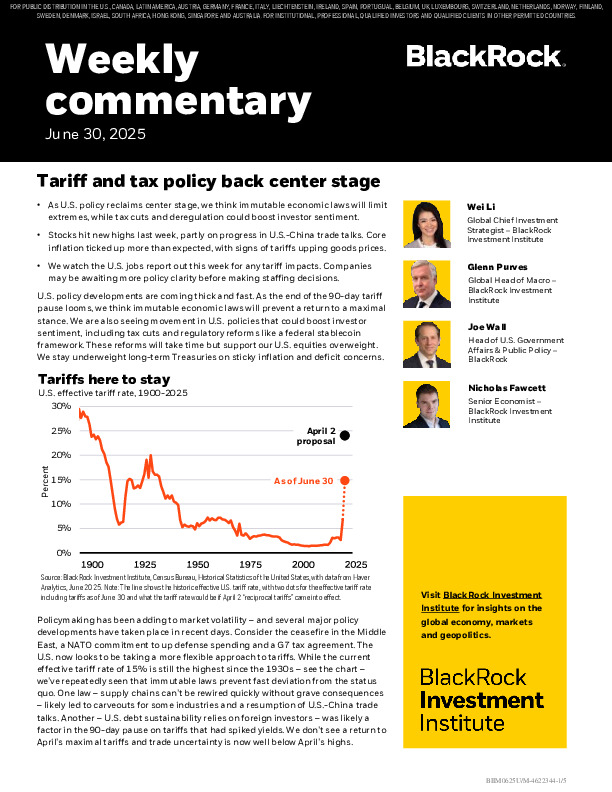

Progress in U.S.-China trade talks and new tax and regulatory initiatives are boosting investor sentiment, while sticky inflation keeps pressure on long-term Treasuries.

-

Tariffs remain elevated but are unlikely to return to April’s highs; reforms like a federal stablecoin framework and AI incentives support a risk-on stance.

-

The team maintains an overweight in U.S. equities and credit, favoring short-duration bonds and infrastructure equity over long-term government debt.

For deeper insights into shifting macro policies and portfolio positioning, read the full report.

Pour lire cet article, vous avez besoin d'un abonnement à Investment Officer. Si vous n'avez pas encore d'abonnement, cliquez sur 'Abonner' pour connaître les différentes formules d'abonnement.