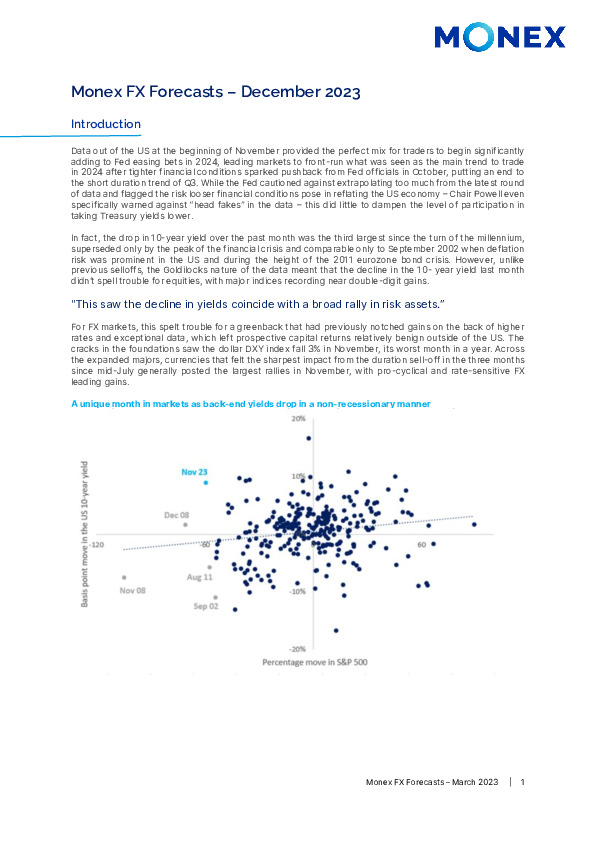

Data out of the US at the beginning of November provided the perfect mix for traders to begin significantly adding to Fed easing bets in 2024, leading markets to front-run what was seen as the main trend to trade in 2024 after tighter financial conditions sparked pushback from Fed officials in October, putting an end to the short duration trend of Q3. While the Fed cautioned against extrapolating too much from the latest round of data and flagged the risk looser financial conditions pose in reflating the US economy – Chair Powell even specifically warned against “head fakes” in the data – this did little to dampen the level of participation in taking Treasury yields lower.

Pour lire cet article, vous avez besoin d'un abonnement à Investment Officer. Si vous n'avez pas encore d'abonnement, cliquez sur 'Abonner' pour connaître les différentes formules d'abonnement.