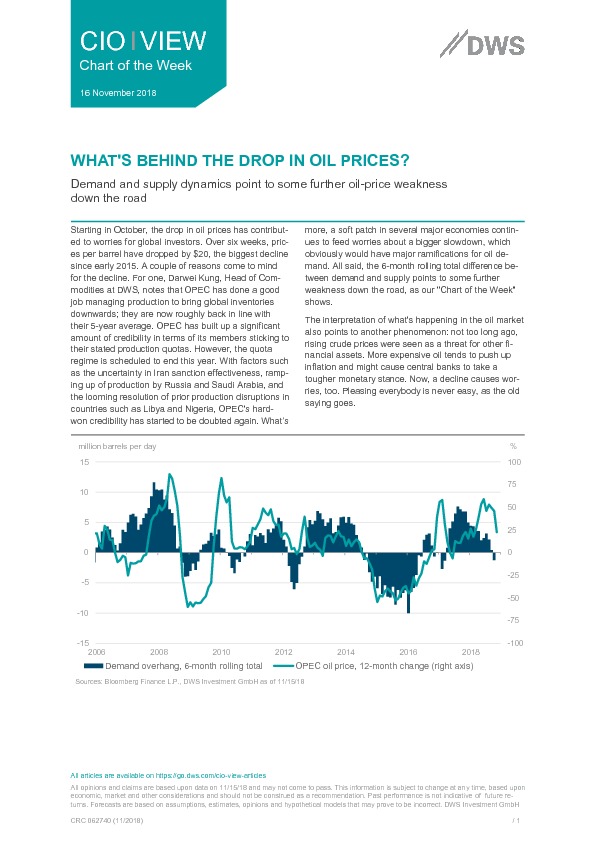

Starting in October, the drop in oil prices has contribut- ed to worries for global investors. Over six weeks, pric- es per barrel have dropped by $20, the biggest decline since early 2015. A couple of reasons come to mind for the decline. For one, Darwei Kung, Head of Com- modities at DWS, notes that OPEC has done a good job managing production to bring global inventories downwards; they are now roughly back in line with their 5-year average. OPEC has built up a significant amount of credibility in terms of its members sticking to their stated production quotas. However, the quota regime is scheduled to end this year. With factors such as the uncertainty in Iran sanction effectiveness, ramp- ing up of production by Russia and Saudi Arabia, and the looming resolution of prior production disruptions in countries such as Libya and Nigeria, OPEC's hard- won credibility has started to be doubted again. What’s more, a soft patch in several major economies contin- ues to feed worries about a bigger slowdown, which obviously would have major ramifications for oil de- mand. All said, the 6-month rolling total difference be- tween demand and supply points to some further weakness down the road, as our "Chart of the Week" shows.