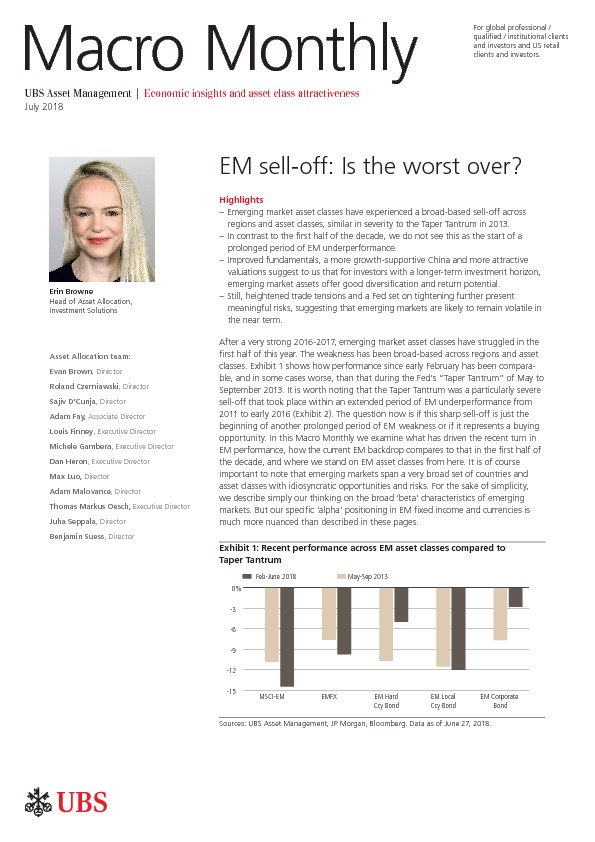

– Emerging market asset classes have experienced a broad-based sell-off across regions and asset classes, similar in severity to the Taper Tantrum in 2013.

– In contrast to the rst half of the decade, we do not see this as the start of a prolonged period of EM underperformance.

– Improved fundamentals, a more growth-supportive China and more attractive valuations suggest to us that for investors with a longer-term investment horizon, emerging market assets offer good diversi cation and return potential.

– Still, heightened trade tensions and a Fed set on tightening further present meaningful risks, suggesting that emerging markets are likely to remain volatile in the near term.

Pour lire cet article, vous avez besoin d'un abonnement à Investment Officer. Si vous n'avez pas encore d'abonnement, cliquez sur 'Abonner' pour connaître les différentes formules d'abonnement.